How to Write a Nursing Case Study? Let the Experts Help You!

In today’s business world, creating a strong brand image is essential to stand out. One of the critical components of building a brand is developing a consistent visual identity that conveys the brand’s message and values.

In today’s business world, creating a strong brand image is essential to stand out. One of the critical components of building a brand is developing a consistent visual identity that conveys the brand’s message and values.

Introduction

When it comes to branding, consistency is key. Creating a consistent visual identity helps build a strong brand image easily recognizable and remembered by customers. In this article, we will discuss the importance of a visual identity, defining your brand’s personality, brand positioning, typography and fonts, logo design, consistent use of visual elements, developing a brand style guide, tips for maintaining consistency and measuring the success of your brand image.

Understanding the Importance of a Visual Identity

A visual identity is the face of your brand. It visually represents your brand’s personality, values, and promise to customers. It includes all the visual elements of your brand, such as colours, typography, imagery, and logo design.

A consistent visual identity is essential because it helps customers quickly recognize your brand. When your visual identity is consistent across all your marketing channels, it reinforces your brand’s message and values, making it easier for customers to trust and remember your brand.

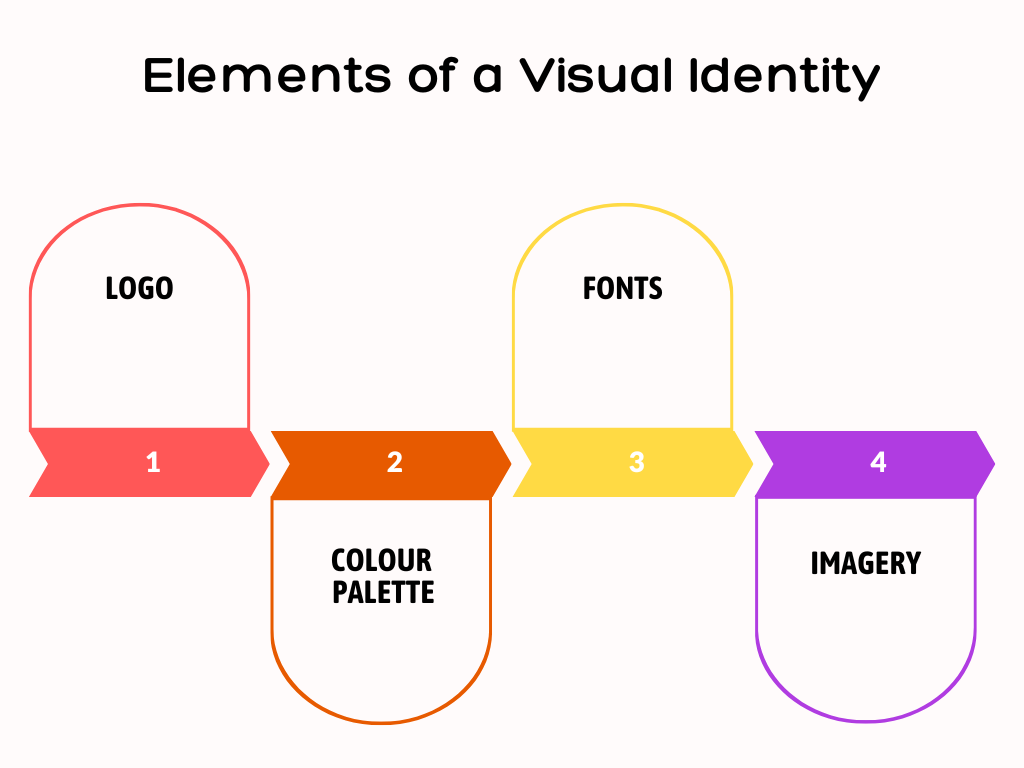

Elements of a Visual Identity

A brand’s visual identity is made up of several elements. These include:

- Logo: A unique symbol or design that represents the brand.

- Colour Palette: A selection of colours that represent the brand’s personality and values.

- Fonts: A set of typefaces used consistently across all branding materials.

- Imagery: The photographs, illustrations, or other visual elements communicate the brand’s message.

Tips for Creating a Consistent Visual Identity

Now that you understand the importance of visual identity and the elements involved let’s discuss some tips for creating a consistent visual identity.

Step 1: Define your brand identity

You must establish your brand identity before developing a unified visual identity. Your target market, brand personality, fundamental values, and beliefs all form part of your brand identity.

You can define your brand identity by answering the following questions:

- Whom are you trying to reach? What are their preferences, requirements, and interests?

- What is your brand personality? Are you friendly, professional, innovative, or traditional?

- What are your core values and beliefs? What do you stand for, and what do you want to achieve?

By defining your brand identity, you may develop a unified visual identity that appeals to your target market.

Step 2: Make a visual style manual.

A visual style guide is a set of guidelines that outlines your brand’s overall look and feel for all platforms. It contains information on your logo, colour scheme, typeface, images, and tone of voice. The following advice will help you create a visual style guide.

- Start with your logo: Your logo is the most important element of your visual identity. It should be unique, memorable, and scalable.

- Choose your colour palette: Your colour palette should reflect your brand personality and be consistent across all channels. Consider using a primary colour, secondary colour, and accent colour.

- Select your typography: Your typography should be easy to read and consistent across all channels. Consider using a serif or sans-serif font, and limit yourself to one or two font families.

- Define your imagery: Your imagery should reflect your brand personality and be consistent across all channels. Consider using a specific style of photography, illustration, or graphic design.

- Establish your tone of voice: Your tone should reflect your brand personality and be consistent across all channels. Consider using a specific tone, such as friendly, informative, or authoritative.

You may develop a consistent visual identity that appeals to your target audience with the aid of a visual style guide.

Step 3: Choose the right colours and fonts

For the purpose of developing a unified visual identity, the appropriate colour and font choices are crucial. Your website, social media accounts, marketing materials, and other platforms should all have the same colour scheme and font. Here are some suggestions for picking the appropriate colour.

- Choose colours that reflect your brand personality: Your colour palette should reflect your brand personality and be consistent across all channels. Consider using a primary colour, secondary colour, and accent colour.

- Use colours strategically: Use colours strategically to create a cohesive image across all channels. Consider using your primary colour for your logo and your secondary and accent colours for your marketing materials.

- Choose fonts that are easy to read: Your typography should be easy to read and consistent across all channels. Consider using a serif or sans-serif font, and limit yourself to one or two font families.

- Consistently use fonts on all of your websites, social media accounts, marketing collateral, and other items.

Consistent usage of colours and fonts will help your target audience better relate to your visual identity.

Step 4: Use imagery strategically

The visual identity of your brand must include imagery. You may use it to promote brand recognition, explain your business’s story, and develop a consistent image across all platforms. Here are some pointers for strategically employing pictures:

- Choose imagery that reflects your brand personality: Your imagery should reflect your brand personality and be consistent across all channels. Consider using a specific style of photography, illustration, or graphic design.

- Utilize photography consistently across all platforms, such as your website, social network accounts, advertising materials, and more. This will assist you in developing a unified brand that appeals to your target market.

- To engage your target audience and communicate the story of your brand, use pictures intelligently. Use imagery to illustrate your brand’s values, promote your goods or services, or elicit a feeling from your target market.

You may develop a recognisable visual identity that appeals to your target audience by strategically using imagery.

Step 5: Ensure consistency across all channels

To build a strong brand image, you must maintain consistency across all media. Your visual identity need to be consistent throughout all of your marketing materials, social media platforms, and website. The following advice can help you maintain consistency across all media.

- Use your visual style guide: Use your visual style guide to ensure consistency across all channels. This includes using the same colours, fonts, and imagery.

- Train your team: Train your team on your visual style guide to ensure everyone uses it consistently.

- Monitor your channels: Monitor your channels regularly to ensure your visual identity is used consistently.

Maintaining consistency throughout all channels can assist you in developing a strong brand image that appeals to your target market or you can take help from brand management assignment.

Conclusion

Creating a consistent visual identity is essential for building a successful brand image. By defining your brand identity, creating a visual style guide, choosing the right colours and fonts, using imagery strategically, and ensuring consistency across all channels, you can create a cohesive image that resonates with your target audience. With the help of management assignment help these tips can build a strong brand image that helps you stand out, establish trust, and differentiate yourself from competitors.

Unlock the key to building a successful brand image with our comprehensive Brand Management Assignment Help. Discover valuable tips for creating a consistent visual identity that resonates with your target audience. Our experts will provide you with the guidance you need to excel in your brand management studies. Don’t miss out on this opportunity, get the support you need for your assignment today!